Universal Studios Demand Finally Cools

Comcast just reported its quarterly earnings for the fiscal first quarter of 2024, and one headline surprised me.

CNBC summarizes what just happened as “Hot films, cooling theme parks.”

Photo: Universal

There’s a sentence we haven’t seen in a while. For the first time since early in the pandemic, park revenue softened.

Let’s discuss what just happened and why some but not all Universal theme parks have slowed down

Comcast’s First Quarter Earnings

Photo: Universal

As a reminder, Comcast is the corporate owner of NBCUniversal and, thereby, all Universal Studios theme parks.

During the pandemic, we learned the ripple effects that the parks suffer when Comcast’s overall business struggles.

Photo: Universal

For this reason, Universal Studios fans should be invested in the financial success of Comcast as a whole. Otherwise, the park budgets get cut.

Thankfully, Comcast had an acceptable quarter, beating Wall Street projections for earnings per share and revenue.

(Jeff Fusco/Comcast via AP Images)

For Q1 2024, Comcast claimed $1.04 earnings per share, slightly besting the predicted $0.99.

Similarly, Comcast earned $30.06 billion for the quarter, which was $250 million more than the predicted $29.81 billion.

Overall, Comcast’s net income, one of the most important metrics, only increased slightly from $3.83 billion last year to $3.86 billion in 2024.

These aren’t the kind of numbers that will wow anybody, but they’re indicative of steady performance throughout the company.

Photo: Comcast NBC Universal

As has been the case lately, Comcast did struggle in a couple of key areas, although one of them trended upward.

Those of you reading UniversalParksBlog for a while are familiar with the strugglers of Peacock, the fledgling streaming service.

Photo: billboard.com

Peacock has been a money pit throughout its existence, but it had arguably its best quarter ever.

Admittedly, that’s not high praise, but it tells a bigger story about NBCUniversal’s early 2024. So, let’s discuss it in detail.

Universal’s Perplexing Streaming Business

Photo: Deadline

This entire conversation goes against everything I believe in, as I’m about to praise a company for losing less money. Yay?

Anyway, during the first quarter of 2024, Peacock owned the exclusive rights to a single NFL playoff game.

Halloween Horror Nights

The company paid $110 million for these rights, which is a LOT. Impressively, the expenditure appears to have paid dividends.

Peacock added three million subscribers for the quarter, a gain primarily attributed to that NFL game and Oppenheimer.

During the playoff game and after it, Peacock hyped itself as the exclusive broadcaster for the Academy Award-winning film.

So, usage of Peacock soared, as did revenue. Comcast indicates growth of 54 percent with streaming income of $1.1 billion.

That sounds spectacular as long as you don’t think about how Peacock lost $639 million for the quarter despite the growth.

Technically, Peacock lost $65 million less in EBITDA than during the first quarter of 2023, but last year didn’t have an exclusive playoff game.

In short, Peacock continues to be a drain on Comcast’s resources, and consolidation rumors are rampant for this reason.

On the internet and cable side, Comcast’s broadband slump continued, which executives attributed to the slowdown in the housing market.

Meanwhile, cable lost another 487,000 customers. We’ve nearly reached the point where only the diehard cable loyalists remain.

Still, Comcast’s overall revenue increased despite the lodestone that is Peacock and the internet/cable issues.

Part of the reason for that is undeniably the parks, although the news isn’t as glowing as it had been in recent quarters.

What Happened at the Parks?

In doing a deep dive on the Comcast filing, Comcast lists theme park revenue as mostly flat.

Technically, Universal Studios gained 1.5 percent of $30 million year-over-year.

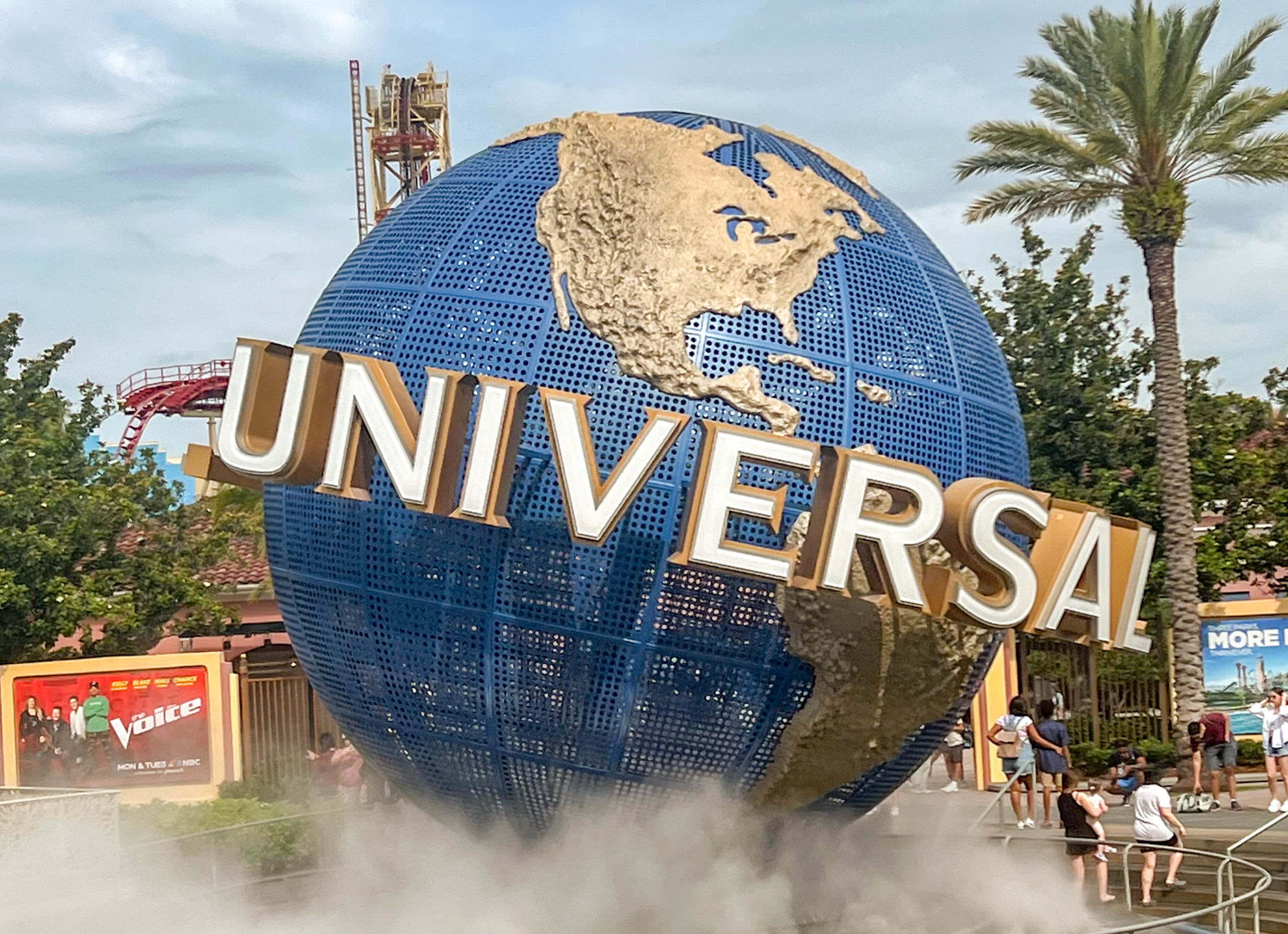

Universal Globe

In Q1 of 2023, the parks division managed $1.949 billion. For the past three months, the total was $1.979 billion.

Meanwhile, EBITDA, an accounting term that corporations prioritize, actually dropped in the quarter.

For 2023, the parks claimed an EBITDA of $658 million. That total dropped $26 million to $632 million for the past quarter.

In short, for the first time in ages, the parks cooled off a bit as CNBC’s headline indicated.

Photo: Universal

The sticking point in early 2024 was that expenses rose for Universal operations.

Comcast spent $1.291 billion on the parks in Q1 of 2023 but that number swelled to $1.347 billion in Q1 2024.

This increase would have been higher if not for the strength of the American dollar as a currency, which helped offset shortfalls at international parks.

Comcast notes that it also spent more money on marketing and promotions during the first quarter of 2024.

Photo: Universal

That’s an understandable expense, given the surging popularity of Universal Studios. You want to remind people to book their summer trips.

Universal Studios also spent more money on capital expenditures.

Photo: Universal

This quarter’s investment of $676 million, which is 3.8 percent higher than a year ago. And yes, that’s because of Universal Epic Universe.

Final Thoughts

Photo: Universal

Notably, Comcast’s filing suggests that Universal’s American parks claimed higher revenue year-over-year.

In a split-off comment during the call, executives noted that Universal Orlando Resort (UOR) was down slightly this past quarter.

Photo: Universal

Overall, UOR was “roughly in line with pre-pandemic levels,” though.

Universal Studios Hollywood increased its totals, presumably due to the full-quarter operations of Super Nintendo World.

Photo: Universal

Remember that this themed land technically didn’t open until February 17th, 2023, although the park offered previews.

So, we’ve finally reached a point where the parks division isn’t claiming record growth each quarter.

Photo: Universal

I presume that’s a hiccup as everyone awaits Epic Universe, but we’ll see.

Thanks for visiting UniversalParksBlog.com! Want to go to Universal? For a FREE quote on your next Universal vacation, please fill out the form below and one of the agents from Let’s Adventure Travel will be in touch soon! Thank you!

Feature Photo: Universal Studios